new hampshire sales tax on vehicles

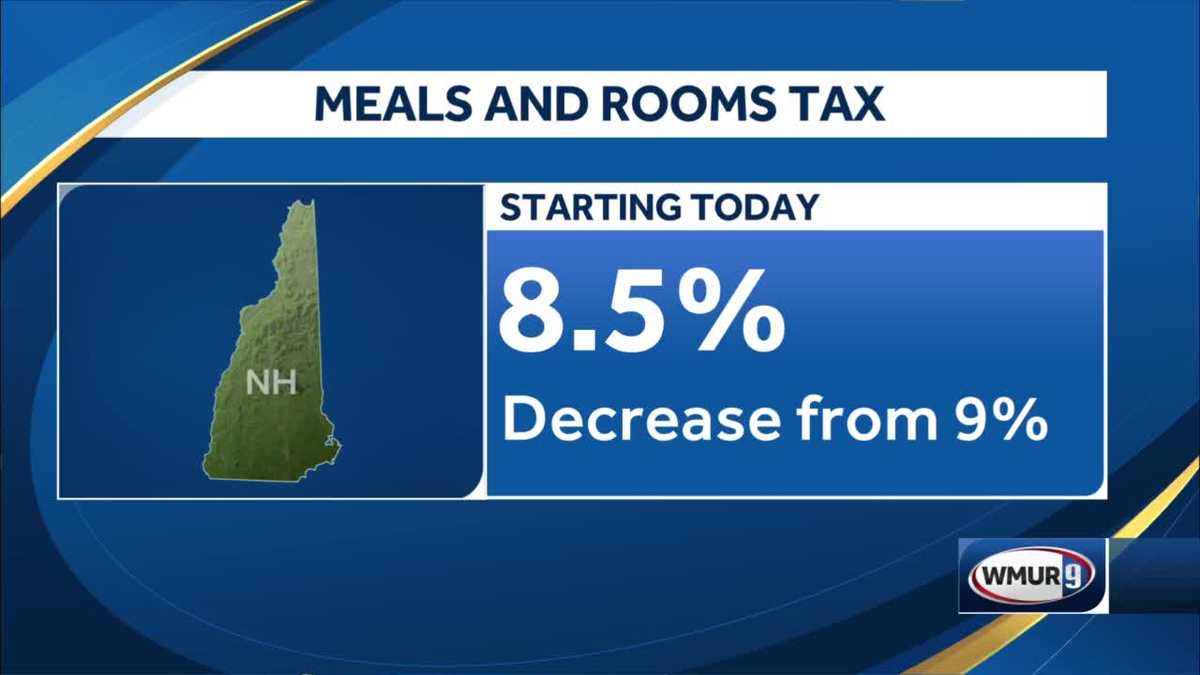

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Motor Vehicle Hearings have resumed in-person hearings or you may.

. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. As long as you are a resident of New Hampshire you wont need to.

New Hampshire is one of only five states that. Combined Sales Tax Range. However vendors in New Hampshire must register for other states sales taxes and.

There are two fees that you will be paying. Interactive Tax Map Unlimited Use. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

Heres how the additional costs associated. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. New Hampshire does not have a sales tax on sales of goods in the state.

Base State Sales Tax Rate. These costs include the registration fee title fee license plate transfer and documentation fee charged by most dealerships. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

Local Sales Tax Range. However you must complete the EPA Declaration Form Importation of Motor Vehicles and Motor Vehicle Engines Subject to Federal Air Pollution Regulations Form 3520-1 making sure. A 9 tax is also assessed on motor vehicle rentals.

The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax. New Hampshire DMV Registration Fees. The reason you dont have to pay sales tax when you buy a car in New Hampshire is pretty simple.

The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax. The local fee is a personal property tax and is based on the original list price of the vehicle. Start filing your tax return now.

For example if you purchased a motor vehicle in New Hampshire on January 1st and brought it into Massachusetts on June 30th a use tax would be due by July 20th. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. The registration fee decreases for each year.

Although walk-in services are available customers with an appointment will be given priority. What states have the. The annual tax rate for the current model.

You need to come back to NH get. The sales tax in New Hampshire NH is presently 0. Ad Lookup Sales Tax Rates For Free.

There is no NH car sales tax. If you are legally able to avoid paying sales tax. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on.

A 7 tax on phone services. Exemptions to the New Hampshire sales tax will vary by state. Motor vehicle rental tax.

New Hampshire Sales Tax Ranges. TAX DAY IS APRIL 17th - There are 169 days left. Exemptions to the New Hampshire sales tax will vary by state.

18 per thousand for the current model year 15 per thousand for the prior model year. Are there states with little to no sales tax on new cars.

What New Car Fees Should You Pay Edmunds

Car Leasing And Taxes Points To Ponder Credit Karma

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

States Without Sales Tax Article

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

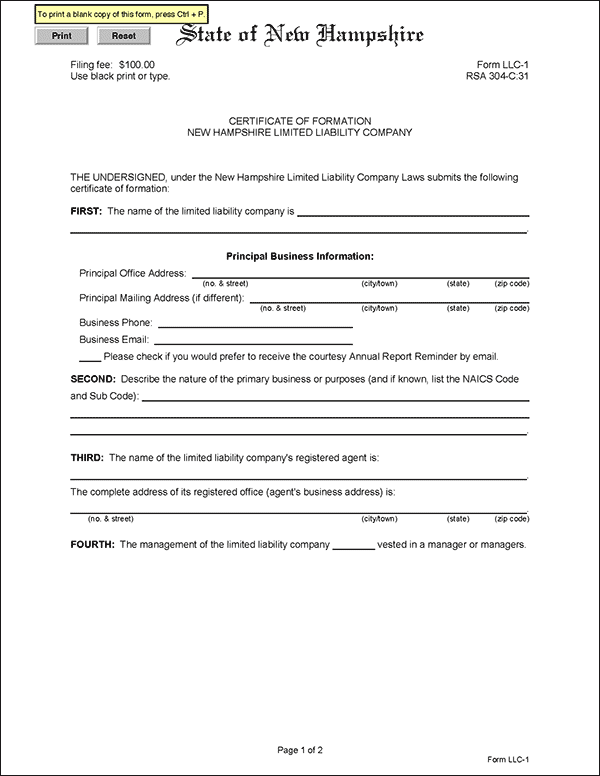

Nh Llc How To Start An Llc In New Hampshire Truic

Is Buying A Car Tax Deductible In 2022

Once Again Property Tax Survey Puts New Hampshire Near The Top Nh Business Review

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Is Buying A Car Tax Deductible In 2022

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

How To Legally Avoid Paying Sales Tax On A Used Car Smartasset

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

New Hampshire Meals And Rooms Tax Rate Cut Begins

Used Cars In New Hampshire For Sale Enterprise Car Sales

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Sales Taxes In The United States Wikipedia