what is fit on a pay stub

FIT deductions are typically one of the largest deductions on an earnings statement. It is the mandatory social security that youll pay.

How To Read A Military Pay Stub Quora

The amount of earnings or deductions.

. A pay stub also known as a check stub is the part of a paycheck or a separate document that lists details about the employees pay. FIT stands for federal income tax. Some entities such as corporations and t.

Fit stands for federal income tax. The Employees social security number. In the united states federal income tax is determined by the internal revenue service.

In the united states federal income tax is determined by the internal revenue service. Add Pay Additional pay. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

This is the amount of money earned during the pay period. Op 4 yr. FIT is applied to taxpayers for all of their taxable.

Pay stubs attest to the fact that both the company and the employee have agreed on a payment system. In the United States federal income tax is determined by the Internal Revenue Service. CNT Pay Contract pay or your salary Hol Holiday pay.

State Tax or State Tax Withheld. FIT is applied to taxpayers for all of their taxable income during the year. What companies offer online payroll accounting services.

The name of the Employee. A company specific employee identification number. Social Security and Medicare.

FICA stands for Federal Insurance Contributions Act. The use of a pay stub generator is easy and takes less than two minutes. These items go on your income tax return as payments against your income tax liability.

It varies by year. The check stub also shows taxes and other deductions taken out of an employees earnings. Federal Tax or Federal Tax Withheld.

Answer 1 of 2. Fit FIT. It covers two types of costs when you get to a retirement age.

The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may. Compupay is an online payroll accounting service that. The FIT gross is what I would expect to see in Box 1 of the W-2.

On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their employees. FedFWTFITFITW - These are abbreviations used. BRVMT Bereavement pay.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. On your pay stub youll see some common payroll abbreviations and some that arent so common. The amount of FIT withholding will vary from employee to employee.

Federal income taxes or FIT is calculated on an employees earnings including regular pay bonuses commissions or other types of taxable earnings. Thereof what is fit on my paystub. FIT tax refers to Federal Income Tax.

The rate is not the same for every taxpayer. FIT means federal income taxes. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

To use a paycheck calculator program you only need to provide information such as the business name and your salary details. Social Security or Social Security Tax Withheld. FIT Fed Income Tax SIT State Income Tax.

Ariel SkelleyBlend ImagesGetty Images. FIT on a pay stub stands for federal income tax. Your net income gets calculated by removing all the deductions.

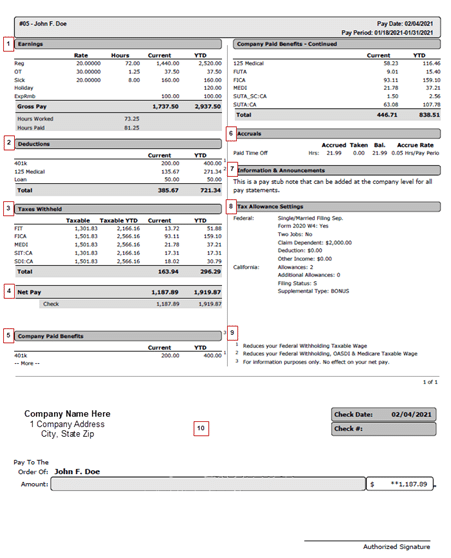

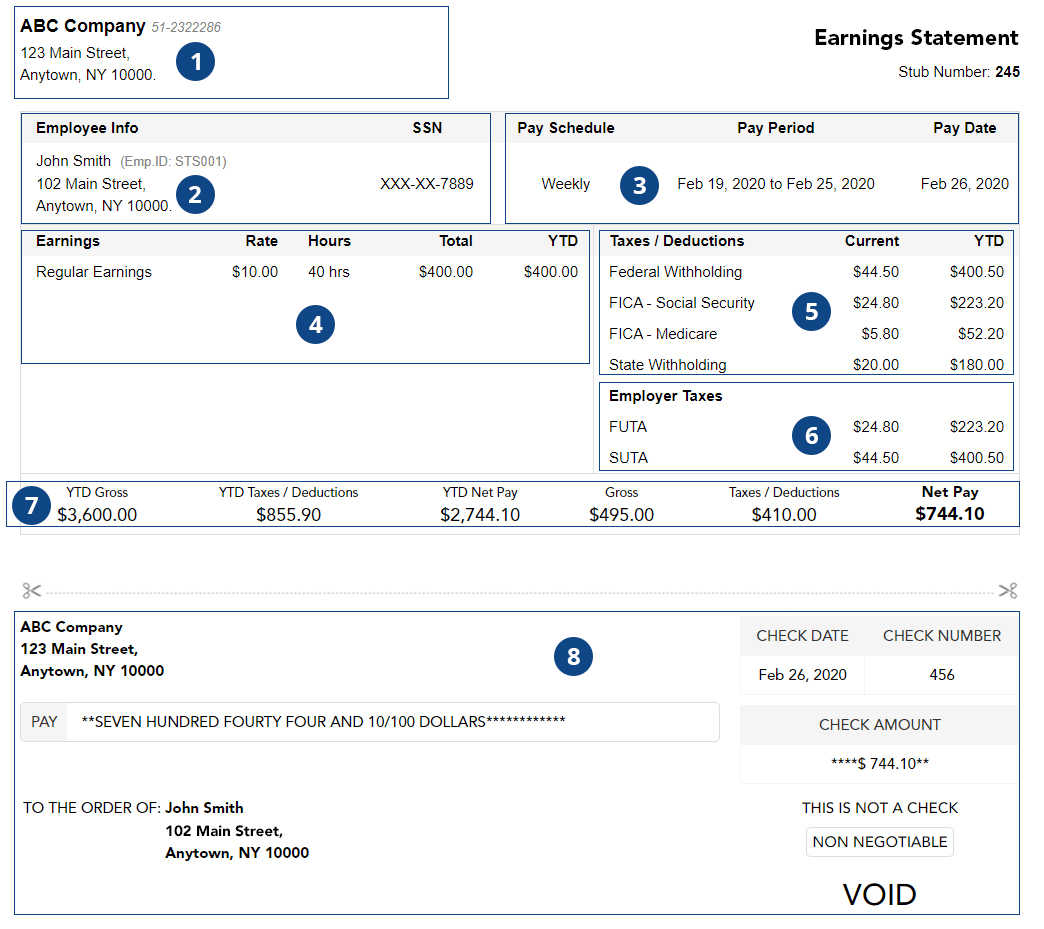

The Reason Behind Giving Your Employees Pay Stubs. This is the information about your specific job. It itemizes the wages earned for the pay period and year-to-date payroll information.

FIT stands for federal income tax. Paycheck stubs are normally divided into 4 sections. This section shows the beginning and ending dates of the payroll and the actual pay date.

This makes sense thank you. Knowing what is. On a pay stub this tax is abbreviated SIT.

A paycheck stub summarizes how your total earnings were distributed. They go toward costs needed to run the federal government. 121 understanding your pay stub.

The rate is not the same for every taxpayer. Click to see full answer. 1 medicare and 2 social.

Here are some of the general pay stub abbreviations that you will run into on any pay stub. Cmp Pyot Compensatory time payout. Federal Income Tax.

The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income. Fit stands for Federal Income Tax Withheld. On your pay stub youll see some common payroll abbreviations and some that arent so common.

How to Read a Pay Stub An Example Pay Stub. Here is a list of paycheck stub abbreviations that relate to your earnings. FIT is applied to taxpayers for all of their taxable income during the year.

At tax time your employees withholding will show on their Form W-2. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket method for standard withholding. FICA means Federal Insurance Contribution Act.

Common Abbreviations Used on Paycheck Stubs. There are four types of taxes taken out of your paycheck every week. This is your home address.

For simplicity you can break them down by pay stub abbreviations found in the header earnings and deductions sections. Some are income tax withholding. TDI probably is some sort of state-level disability insurance payment.

In most cases you will see money held back from your paycheck for two government-funded programs. Paycheck stubs are normally divided into 4 sections. These are the most common ones.

In the United States federal income tax is determined by the Internal Revenue Service. Personal and Check Information. This is an important one to look at especially.

Pay Stub Abbreviations And Acronyms Decoding Tips

Hrpaych Yeartodate Payroll Services Washington State University

What Are Pay Stubs 5 Reasons Your Small Business Needs Them

What S The Stub Of A Paycheck Quora

Pay Stub Abbreviations And Acronyms Decoding Tips

Understanding Your Pay Statement Innovative Business Solutions

What Everything On Your Pay Stub Means Money

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Understanding Your Paycheck Credit Com

The Ultimate Check Stub Template Monday Com Blog

Paystub Excel Template The Spreadsheet Page

A Guide On How To Read Your Pay Stub Accupay Systems

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Pay Stub Understanding Paycheck Stub

Sample Pay Stub Opportunities For Wbc

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Pay Stub Abbreviations And Acronyms Decoding Tips